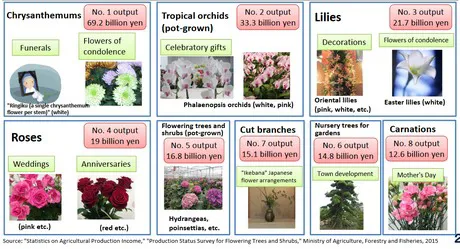

Output flowers and plants

The output of flowers and plants came to 380.1 billion yen in 2015, accounting for 4% of the total agricultural output. Of the total output of flowers and plants, cut flowers accounted for approximately 60%, potted plants about 30% and seedlings for flower beds about 10%. When further breaking down the output of flowers and plants, we can see that the Chrysanthemums rank first as they account for 18% of the total output of flowers and plants in 2015, followed by tropical orchids (9%), lilies (6%), roses (5%). The output of flowers and plants has been on a declining trend for all items since peaking in 1998, due mainly to an increase in imports of cut flowers and a drop in the number of flower growers.

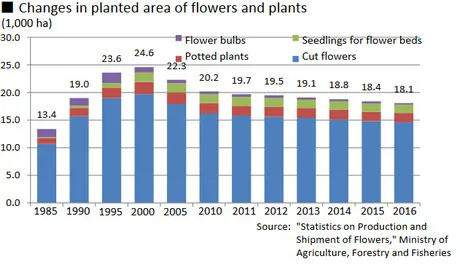

Production of flowers and plants

And this decreasing trend in output is probably related to the decrease in planted area, which also declined. Since peaking in 2000, the planted hectares decreased by over 26%. Cut flowers account for the largest production area, around 80% of the total planted area of flowers and plants. And the most produced crop, accounting over 80 percent, have seen the most significant drop, they decreased by around 25 percent.

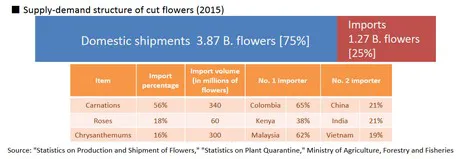

Imported flowers

Cut flowers account for the vast majority of imported flowers and plants and since 1985 when the custom duty was abolished, they have been on an increasing trend. In 2015, 25% of the cut flowers are imported (on volume basis), with carnations (56%), roses (18%) and chrysanthemums (16%) ranking high in import percentages. The chrysanthemums are mainly imported from Colombia (65%), roses from Kenya (38%) and chrysanthemums from Malaysia (62%). And when looking at the change in import ratio of carnation and chrysanthemum of 2005 and 2015 significant changes can be noticed. In these 10 years, the import percentage of carnations and chrysanthemums almost doubled.

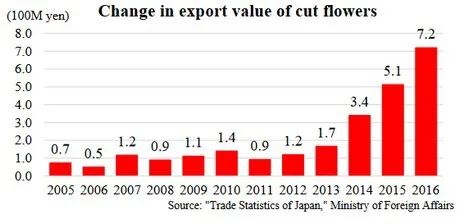

Export of plants and flowers

Garden trees, bonsai and potted plants accounting for the vast majority of export value in 2016 (8.8 billion). Interestingly, although the share of cut flower is low, the absolute value has grown significantly. Since 2013, the export value of cut flowers increased drastically from 0.17 billion yen to 0.72 billion yen. The main countries to which the Japanese cut flowers are exported are Hong Kong, followed by the US, China, Korea, the Netherlands and Taiwan. Of these countries, the change in export value over the last years is the largest in the US. According to the report, this general increase in export value is thanks to promotional activities in export partner countries, and so on. The increase in the US, according to the report, is mainly due to the demand for rare flowers and gorgeous floral materials for highend parties, fashion events, etc. "As Japan started efforts for expanding the export of quality Japanese flowers, export value of cut flowers to the U.S. in 2016 reached 0.19 billion yen, or a 3.8- fold increase compared to four years ago."

Increasing exports

The export value of flowers and plants (export items of focus) in 2016 was 8.8 billion yen, but Japan is expected to drastically increase this value by 2019. "Based on the Strategy on the Enhancement of Export Power in the Agriculture, Forestry and Fishery Industries that was formulated in May 2016, Japan aims to increase the export value of garden trees, bonsai, potted plants and cut flowers to 15 billion yen by 2019 by communicating the attractive features of Japan‐made flowers and plants that flowers and plants made in mass producing countries lack.

For more detailed information about the production, market imports and exporters of Japanese flowers and plants, the Japanese flowers and plants in the world, the consumption of flowers and plants and ideas to revitalize floriculture in the country. Click here for the entire report.