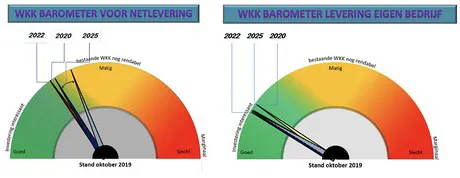

The CHP gas engine did maintain its good market position in the first half of 2019. This can partly be explained by the growing import and export with neighboring countries, resulting in a greater exchange of electricity. This provides more CHP operating hours and higher prices in winter, but also lower prices in summer. The barometer readings for October 2019 are shown below. Overall, the barometer has improved slightly compared to the spring position.

Developments Q1-Q3 2019

The first quarters of 2019 showed the same picture as in 2018; net export in winter and import of renewable energy during the day in summer. Further analysis shows that this import/export balance is strongly linked to the supply of sustainable power, windy and sunny periods result in daytime import, but during the nights the Netherlands export to neighboring countries.

Striking is the effect of local sustainable generation. On sunny days, there is a clear reduction in consumption from the high-voltage grid. This can be explained by solar panels that are generating ‘behind’ the meter, so that less is taken from the grid.

Market position 2020

The spark spread for electricity production in the Netherlands is improving because of the decreasing capacity, including the shutdown of the Hemweg coal-fired power plant (630 MWe). A second effect is that there are persistent durations of winter scarcity in neighboring countries, resulting in price peaks. This situation is favorable for the CHP that is supplying to the grid and that seems to continue until after 2020. The situation of a CHP that runs for lighting during night hours is also very favorable in combination with the grid supply during the day. The greatly increased Sustainable Energy Storage (ODE) in the third disk (50,000 - 10 million kWh) improves the position of CHP for lighting.

Investing in new CHP for grid supply only is generally reasonably profitable in 2020. The return also depends on the integration. Own use of electricity from CHP improves the situation, depending on the ratio of own use and grid supply. Investing in CHP for lighting is certainly profitable.

Read more at Kas als Energiebron about the market position in 2022 and the outlook for 2025.