The Dutch horticultural industry has had a decent 2019, as Rabobank notes in the latest edition of the Rabo Horticulture barometer. The operating return for most companies was sufficient. However, the entrepreneurs are increasingly worried about labor, the authorization of crop protection products, and the recent discussions regarding nitrogen regulations.

This update also discusses how:

- Sustainability plays an increasingly important part in the financing of the (greenhouse) horticulture industry.

- Ornamental breeding takes the first steps towards (pre-competitive) collaboration.

- New ideas for the Food & Agriculture sector are covered at FoodBytes!

Rabo Horticulture barometer: all-in-all a decent 2019

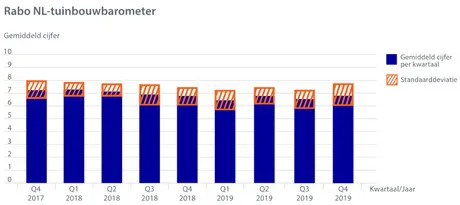

The average results for the horticultural industry are satisfactory in the fourth quarter of 2019, as can be seen in the most recent Rabo Horticulture barometer. The values increased from 6.52 in the third quarter to 6.88 in the fourth quarter. Because of this, it seems like the horticultural industry can regard 2019 as a decent year overall. Nonetheless, there are still significant individual differences between companies.

Ornamental cultivation

For the cut flower companies, the average financial performance is substandard, as can be seen in the pricing of the gerbera and red roses. Furthermore, the concerns regarding the production guarantee are increasing due to not using of a variety of chemical crop protection products. Potted plant companies, on the other hand, generally perform according to estimations. The leafy plants are still profiting from a high demand while the crisis on the Phalaenopsis market, unfortunately, is still not resolved. The tree cultivation companies still have a good order book and should be able to build a (cash) buffer in their current state. The spring plant companies in bulb cultivation experienced a good production this year, and presale prices for the bulbs were reasonable. The availability of tulip bulbs for the coming flowering season is good. The pricing, however, is still unknown.

Encouraging numbers from wholesale and retail

The export of flowers and plants is going well: up until September of this year, there was an increase of 3.5%. A higher import causes this increase on the one hand, and on the other, by an increase in volume and price on a national level. The national retailers dealing in greeneries (florists, garden centers) also show encouraging sales figures. Research conducted by the Union of Florists and Shopkeepers (VBW) shows that especially millennials are able to find their way to the florists.

However, recent figures of Statistics Netherlands showed (yet again) an apparent decrease in the number of greengrocers. In the fourth quarter of 2010, the Netherlands still had 1,220 greengrocers. In the fourth quarter of 2019, this number decreased to 895 greengrocers. This would mean that in the past decade, a vegetable specialist in the Netherlands closed shop almost every two weeks.

Food horticulture

The fruit vegetables in greenhouses have had a reasonable season thus far. Cucumbers have picked up the pace after a rocky start, while the peppers have seen a steady satisfactory period. The average tomato price also ended up around the five-year average, in some cases even exceeding it. Strawberry cultivation, on the other hand, whether from greenhouses, tunnels, racks, or in the open ground, had difficulty selling.

The vegetables cultivated in the open ground were reasonably priced this year. However, (extra) measures were needed for watering due to the drought, which led to additional costs.

The returns for top fruit, like apples and pears, were mediocre in the 2018/19 season. The fruits for the new season have been harvested by now, and the outlook is more favorable than in previous seasons. Supply and demand seem to be balanced out better, which leads to a better price.

Sustainability is taken into account with financing

When requesting funding, it used to be the case that the business and market perspective, as well as the financial situation (profitability, liquidity, solvency), were the main factors. In particular, they looked for long-term continuity of business operations. Nowadays, sustainability criteria also play an increasingly important role in the assessment. Is a company capable of playing along with social rules in the long term? Examples of this are the requirements and conditions that arose from the climate agreement, from the new regulations involving plant health and crop protection, or even being a good employer. To ensure that the new rules and regulations, as well as the consumers' wishes (certification requirements), can be met, significant investments are needed. It is these criteria, in combination with the financial sturdiness, that decides the business continuity in the long term.

Sustainability classification

The Rabobank has been keeping track and classifying a number of greenhouse horticulture companies on how they score on specific sustainability criteria for about a year and a half. Category A are the market leaders in terms of sustainability, category B the large group that is average, category C the latecomers (who do meet the regulations), and category D consists of the unacceptable companies (that don’t meet the rules and regulations). By now, this classification has also been employed for other horticulture sectors. The inclusion of sustainability criteria in the financial policy helps the Rabobank make an estimation when it comes to providing credit or loans, and the repayment of them.

Financial stimulation

In the case of large funding sums, only companies in category A or B will be facilitated. Companies in these categories can qualify for a reduction in the interest rate on account of innovativeness and sustainable financing. Examples of this are the impact loan and green financing.

Companies in the C category are first requested to make sustainable changes in their business operations. In case they are not prepared or capable of doing so then, as far as the Rabobank is concerned, the business continuity in the long term is not guaranteed, and therefore neither is the repayment of the loan.

Next step ornamental cultivation: Center for Organic Tests

The Dutch ornamental cultivation industry realizes an export of about 8.5 billion euros. One of the reasons for this is a diverse and strong breeding sector that knows how to provide the rest of the industry with new, beautiful, colorful, and easy to cultivate varieties. It estimated that around 3,500 employees work in the Dutch ornamental breeding sector. All in all, it is a very important sector.

However, the demands have been getting more and more complex due to regulations and consumer wishes over the years, and time is of the essence. For instance, the use of active substances (chemical crop protection products and fertilizers) within the sector needs to be lowered. Resilient flowers, plants, and organic crop protection are essential to achieve this. Plant breeders are able to contribute to this in a big way, but more is needed: collaboration.

Collaboration

A variety of organizations such as Plantum, Naktuinbouw, WUR, and UvA have started the program called ‘Next level ornamental cultivation breeding’. The goal of the program is to answer the pre-competitive knowledge questions that exist in the ornamental cultivation breeding industry together. By now, the first project of the program, which is the ‘Center for Organic Testing’ has started. The goal of the project is to develop the necessary organic tests (assays) that companies are able to use in their selection process. The Rabobank is actively participating in the program and hopes that in doing so, the sector will increase the speed with which they develop sustainable options in their product range through resilient crops. Fortunately, the breeding companies also seem to be very interested in the program, which shows the need for collaborations similar to the ones between the startups and investors at Foodbytes!

Foodbytes! A successful platform for startups

In 2015, the Rabobank started the innovation program known as Foodbytes! In autumn of this year, the 15th event of Foodbytes! took place in London. During this edition, an impressive 157 startups from 38 different countries brought their ideas to the event. The Rabobank provided a first screening of the plans that have been sent in, after which some of the startups had the unique opportunity of presenting their ideas to an audience made up of scientists, investors, entrepreneurs, and funders.

Inspiring trends within the industry

The most relevant trends among the ideas that were sent in are with regards to alternative proteins, sustainable packaging, ‘personalized nutrition’, circularity, robotization, smarter product chains, indoor farming, and business models for outdoor eateries. And what to think about the salt that comes from the Salicornia plant or the production of egg substitutes made from fermented yeast and algae? The ideas are endlessly inspiring.

A variety of themes

Besides innovativeness, the ideas that are being sent in can also be classified into different categories. For example, in one of the four pillars of the Rabobank. In that case, the division is as follows: 44% of the plans are with regards to nutrition and health, 20% have the intention of achieving a more sustainable production, 22% attempts to prevent wastage, and 14% focuses on the stability of income.

Source: Rabobank