Myplant & Garden, the Italian trade fair for horticulture, garden, and landscape in Italy (Fiera Milano Rho, 21-23 February 2024), takes a snapshot of the green sector: "Comforting signs of slight growth in the Italian sector - commend the organizers - in a context of uncertainty that presses on business and consumers in Europe and around the world. Conflicts, inflation, high energy prices, difficult access to credit, and weather fluctuations are the main concerns. Italian production and exports are doing well despite the import increase. Domestic market with ample chance for improvement." In this article, they give some statistics on the green sector, not only in Italy but also in Europe and even overseas.

Production Italy

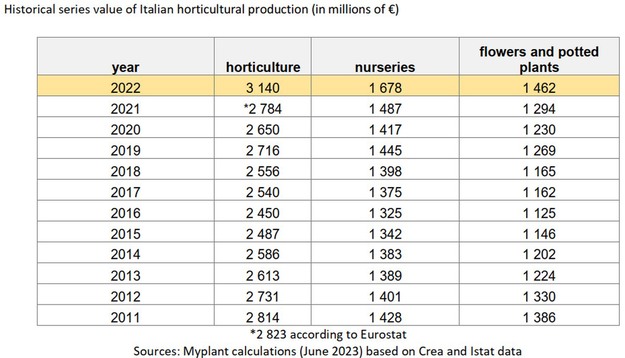

In 2022, the value of the production of greens that are 'made in Italy' exceeded 3.1 billion euros, the highest figure in the historical series of the last decade (source: Istat).

Italy is Europe's second-largest exporter of horticultural products, with over 1.2 billion euros (a new record in the historical series). The positive trend in exports guarantees a positive trade balance.

The 27 EU countries are the main market for Italian products (about 80%).

In terms of international production, the global value of the production of flowers and ornamental plants is estimated at 53 billion euros (details below).

The EU production value of flowers and ornamental plants is estimated at €21.4 billion (details below).

The core Italian production companies are mainly concentrated in 4 regions: Liguria, which has the primacy of companies that grow flowers in the open air; Tuscany, Lombardy, and Sicily, where the main ornamental shrub and forest nursery activities are located; Campania, where the companies are mainly specialized in the cultivation of flowers in protected cultivation.

Italy has ample chance to develop a not-yet-mature internal market.

According to Istat data (2021), spending on flowers, plants, and related products in Italy stopped at 39 euros/person. Switzerland leads the continental ranking of per capita expenditure with 126 euros/person, followed by Denmark and Great Britain (124 euros/person), Germany (106), Austria (98), France (92), and Belgium (84 euros/person).

Overseas, the 169 euros of per capita expenditure in the USA stand out (total expenditure estimated at 56 billion euros).

EU import-export (details below):

EU cut flower imports: €4.1 billion in production value.

EU cut flower exports: €4.9 billion in production value.

EU, imports of potted plants: €4.5 billion in production value.

EU, exports of potted plants: €5.8 billion in production value.

Focus Italy

Italy is the second largest European exporting country of horticultural products (behind the Netherlands and before Germany and Spain). Italian exports reached 1.23 billion euros (production value), up slightly in 2021 (Istat, Eurostat, AIPH).

The volume is generated mainly by the 780 million ornamental plants and nurseries (excluding fruit trees and shrubs, which are worth 90 million), the 300 million euros of potted plants, the 170 million euros derived from foliage, branches, mosses, lichens, etc., cut, fresh or treated, and the 135 million euros of cut flowers.

The good performance of exports guarantees a positive trade balance (+370 million) despite the increase in imports (from 600 to 865 million).

The 27 EU countries are the main market for Italian products (about 80%).

70% of Italian exports are destined, in order, to France and the Netherlands (225 million each), Germany (194), the United Kingdom (54 million) and Switzerland (47 million).

The Netherlands (€580 million), Germany (€44 million), Spain (€43 million), and Belgium (€36 million) are the main import markets for Italy.

Flowers and ornamental plants in the world

As anticipated, the global value of the production of flowers, ornamental plants, and nurseries is estimated at 53 billion euros.

The EU production value of flowers, ornamental plants, and nurseries is estimated at €21.4 billion.

In the world, according to Eurostat estimates, the production value of flowers and ornamental plants (no nursery) is 25 billion euros (1,462 billion in Italy), generated by 300,000 companies in the sector on an area of 680,000 hectares.

To these numbers are added those of the nursery: 28 billion in production value (1,678 billion in Italy) and 61,000 companies.

The European value of the production of flowers and ornamental plants (no nursery), generated by 33,000 companies on 55,000 hectares, is 9.4 billion - 10 times as much as African production and almost double that of North America (Eurostat, AIPH).

Asian production is driven by China, which fluctuates between 7 and 8 billion euros. In the Asian case, the hectares dedicated to the production of flowers and ornamental plants exceed 520,000 (India and China lead the world ranking in this regard) and involve almost 100,000 companies.

In South America, 45,000 hectares of land are cultivated by 8,000 companies, generating €1.6 billion in production value.

The production value of the European nursery is 12 billion euros, with an estimated 20,000 companies in the sector.

Also, in this case, China, on the nursery front, produced over 9 billion euros (source: China Flower Association) compared to 12 in Europe, which is equivalent to twice as much as North American production.

Import cut flowers

EU countries imported 4.1 billion cut flowers in 2022 (1.3 billion in the Netherlands, 1.2 billion in Germany, and Italy at 236 million).

European but non-EU countries imported 1.5 billion cut flowers, more than half of which was the prerogative of Great Britain (840 million), followed at a distance by Russia (340 million).

The American continent imported flowers for over 2.5 billion, driven almost entirely by the USA.

Asia recorded imports of €850 million, mainly driven by Japan (€315 million).

Import potted plants

EU countries imported 4.5 billion potted plants in 2022 (1.3 billion in Germany, 900 million in the Netherlands, 620 million in France, and Italy at 374 million).

Great Britain, for non-EU countries, has imported over 425 million euros of potted plants (Eurostat, AIPH).

EU imports of horticultural products from non-EU countries amounted to €2.46 billion, of which €1.6 billion went to the Netherlands. The main sourcing markets are Kenya (over 600), then Ecuador (over 300), and Ethiopia (over 200).

The same sequence was recorded for the cut fresh flower: EU imports at 1.58 billion, 60% destined for the Netherlands, mainly from Kenya, Colombia and Ethiopia.

Of the 450 million imports of ornamental plants, almost 300 million have reached the Netherlands.

Export of cut flowers

EU countries exported €4.9 billion in cut flowers in 2022 (€4.5 billion in the Netherlands, €135 million in Italy, in second place), source Istat, Eurostat, AIPH.

Ecuador (€970 million) and Colombia (€470 million) led the Americas (exports of cut products at €1.7 billion). This is followed by Africa (900), with Kenya dominating (600) and Asia (450).

Export of potted plants

EU countries exported €5.8 billion in potted plants in 2022 (€4 billion for the Netherlands, €620 million for Germany, then Belgium with over €320 million and Italy with €300 million).

In a global framework that is not easy to outline, Italy consolidates its role as a protagonist. "Three months before the opening, we already count on the presence of 79 delegations of buyers from 28 strategic countries and 4 continents - Europe, America, Africa, and Asia. Internationality is in Myplant's DNA, and we are convinced that the attractiveness of the Italian product, as well as domestic demand, have significant growth margins."

For more information:

Myplant & Garden – International Green Expo

Emial: [email protected]

www.myplantgarden.com