Looking at China's floricultural trade between January and September 2025, one thing is clear: the market is buzzing. Export growth is accelerating, bulb imports are booming, and new markets are reshaping the landscape. For Dutch floriculture companies, the data offers both reassurance and opportunity.

China's floricultural imports: the Netherlands holds the top spot

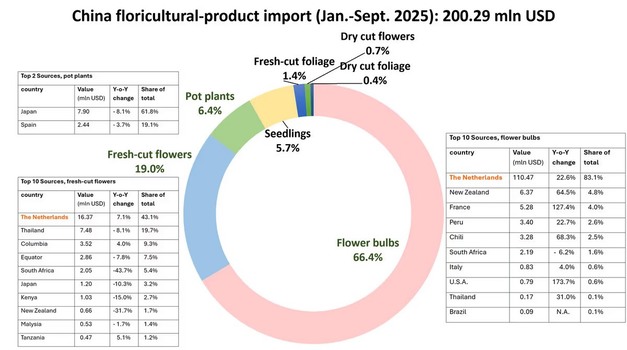

In the first nine months of 2025, China has imported a bit more than 200 million USD (170.4 million euro) in floricultural products, a 12.4% growth from the same period last year. Two-thirds of this is flower bulbs, in which the Netherlands absolutely dominates.

© LVVN China

© LVVN China

Bulbs imported from NL: 110.5 million USD (94.2 million euros). That's 83.1% of all bulb imports. Even better: NL bulb exports to China grew by 22.6% year-on-year. Dutch bulbs remain essential for China's horticultural production. New Zealand and France also grew sharply, but from much smaller bases. Demand is strong and growing.

16.4 million USD (14 million euros) worth of Dutch fresh-cut flowers imported by China, which is 43% of the total import in the category. Thailand is second (19.7%), followed by Colombia, Ecuador, South Africa, and Kenya. Notably, China's total fresh-cut flower imports fell by 7%, but imports from NL still grew slightly (+7.1%). The Netherlands holds its position in premium segments.

© CFNAData Sources: China Richland Sources, referring to General Administration of Customs of China (GACC) and China Chamber of Commerce of Import & Export of Foodstuffs, Native Produce & Animal By-Products

© CFNAData Sources: China Richland Sources, referring to General Administration of Customs of China (GACC) and China Chamber of Commerce of Import & Export of Foodstuffs, Native Produce & Animal By-Products

China's exports: fresh-cut flowers blooming like crazy

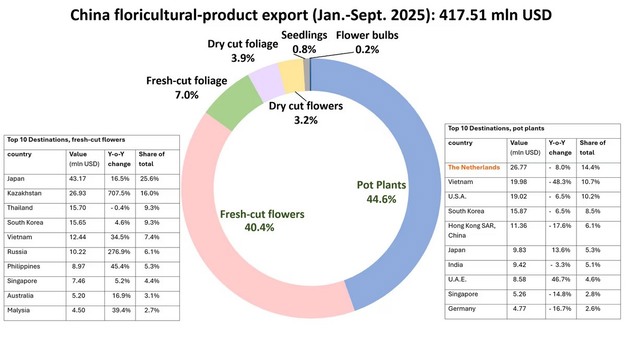

China exported 417.5 million USD (355.7 million euros) worth of floricultural products (+12.7% year-on-year). The star performer? Fresh-cut flowers. +47.1% and now good for 40% of all exports.

Japan remains the no. 1 buyer, taking 25.6% of China's fresh-cut flower exports. Kazakhstan suddenly appears as a floral rocket: exports grew 7-fold to 26.9 million USD (22.9 million euros). Thailand, South Korea, Vietnam, Russia, and Singapore all show active demand.

Pot plants export is still big, but losing steam. It remains China's biggest export category (44.6% of total exports), but declined by 4.1%. The Netherlands is the largest export destination.

© CFNAChina Richland Sources, referring to the General Administration of Customs of China (GACC) and the China Chamber of Commerce of Import & Export of Foodstuffs, Native Produce & Animal By-Products

© CFNAChina Richland Sources, referring to the General Administration of Customs of China (GACC) and the China Chamber of Commerce of Import & Export of Foodstuffs, Native Produce & Animal By-Products

Takeaways

Kazakhstan is now China's second-largest market for fresh-cut flowers. China exports more fresh flowers to Singapore than Australia. The Netherlands sells China more than 100 million USD (85.2 million euros) in bulbs — that's roughly the value of 100 million tulip bulbs, depending on variety.

China's floricultural sector continues to globalize, diversify, and upgrade. Dutch companies, with strong brand reputation, technical advantage, and premium genetics, are well-positioned to benefit from these shifts.

What does this mean for Dutch floricultural companies?

Bulbs remain a golden ticket, as China's bulb demand is booming, and the Netherlands remains irreplaceable. Varietal innovation and logistics reliability can further expand NL's dominance.

While China reduces lower-end imports, it still buys premium-quality fresh cuts from the Netherlands. Branding Dutch flowers as luxury, sustainable, or seasonal specialty could win new ground.

Collaboration opportunities in fresh-cut production. China's own fresh-cut flower export boom signals the expansion of greenhouse and modern cultivation areas. This opens doors for greenhouse tech, post-harvest systems, breeding partnerships, and joint ventures in new regions.

China is increasingly becoming a bridge exporter to the nearby markets in Kazakhstan, Russia and Southeast Asia.

Source: Agroberichten Buitenland