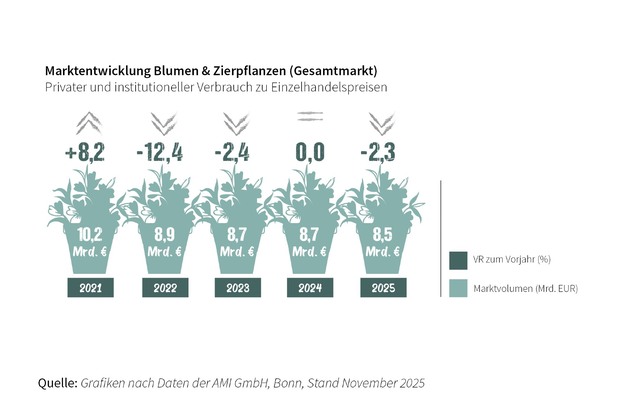

Current market data show that the German market for flowers and ornamental plants was unable to emerge from its weak phase in 2025. Despite temporarily more moderate inflation, consumers' willingness to spend remains subdued, as economic uncertainty, real income losses and rising living costs continue to have a lasting impact on purchasing behavior. The downturn extends across almost all subsegments, underscoring that this is not a short-term effect but rather a set of structural challenges the industry and trade must address, ZVG says. © ZVG

© ZVG

According to estimates by Agrarmarkt Informations-Gesellschaft mbH (AMI), based on the first three quarters of 2025, the market for flowers and ornamental plants shrank in 2025 to a level of €8.5 billion (at retail prices).

As a result, per capita spending in the past year fell by more than €2 to around €102. This is about €6 less than in 2019, before the pandemic and the subsequent consumer uncertainty.

"We still see potential for our products," emphasizes ZVG President Eva Kähler-Theuerkauf. The decisive factor, she says, will be when consumer confidence returns.

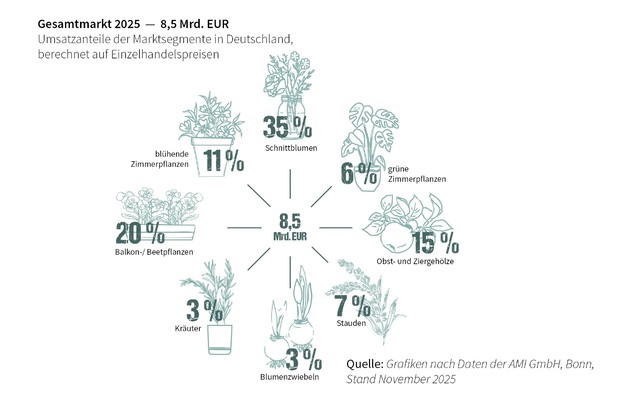

Even garden plants (bedding and balcony plants, perennials, herbs, woody plants and flower bulbs) missed their previous year's result by more than one percent, primarily due to weather conditions, reaching a market volume of €4.1 billion (at retail prices). Consequently, per capita spending in 2025 fell below €50, as end consumers spent less on plants across all subsegments—except flower bulbs—than they had a year earlier. Bedding and balcony plants, the largest segment within garden plants, recorded a year-on-year decline of around one percent, reaching a market volume of approximately €1.7 billion (at retail prices). This puts the level almost 7% below that of the pre-pandemic year 2019. © ZVG

© ZVG

The houseplant market also contracted in 2025, according to AMI estimates. In total, the market volume amounted to €1.4 billion, representing a decline of 4.5% compared with 2024. Both green and flowering houseplants remained below their previous year's levels. The decline in flowering houseplants, at around 5%, was somewhat more pronounced than for green houseplants, which fell by less than 4%. This means that, on a per capita basis, each resident of Germany spent around €11 on flowering houseplants in 2025 and less than €6 on green houseplants.

For cut flowers alone—still the largest market segment—per capita spending fell by more than €1 year on year to less than €36. As a result, cut flowers no longer quite reached a market volume of €3 billion (at retail prices).

Overall, the situation at the end-consumer level did not improve in 2025. In addition to the already familiar issues surrounding consumer uncertainty, concerns about job security due to the weakening economic situation were added. Although inflation slowed over the course of 2025, this did not lead to any noticeable relief for consumers. The absence of wage increases, combined with persistently high energy costs and the tense situation on the housing market, also weighed on consumers. While political measures are being prepared for 2026 to stimulate the economy and ease the burden on consumers, positive impulses are likely still some time away.

Source: ZVG