A targeted survey of U.S. floral leaders shows steady revenue performance, margin pressure, and little measurable impact from the Saturday holiday placement. With Valentine's Day 2026 falling on a Saturday — and preceded by tariff discussions, higher freight costs, rising labor expenses, and winter weather disruptions in parts of the United States, expectations heading into the holiday were mixed.

To better understand actual market performance, a peer-to-peer Valentine's Day 2026 Floral Industry Pulse Survey was distributed directly to more than 40 U.S. industry leaders across segments.

The survey achieved a 39% response rate, representing growers, importers, wholesalers, multi-location retailers, and independent florists across multiple U.S. regions. The objective was straightforward: report what businesses experienced without forecasts or broad claims.

© Florabundance

© Florabundance

Valentine's week product display at Florabundance in Carpinteria, California. A wide mix of roses, hydrangea, hypericum, carnations, gerbera, and seasonal greens prepared for nationwide overnight distribution

Overall sales performance

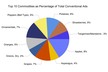

A clear majority of respondents reported higher overall sales compared to Valentine's Day 2025. Approximately two-thirds indicated sales were either slightly or significantly stronger than the prior year. A smaller portion described results as similar, while a limited group experienced declines. Across segments, the prevailing assessment was: steady and good though not record-setting.

Volume and pricing trends

Most respondents reported stable to improved stem and bouquet volume year over year. Pricing adjustments were generally measured. The majority implemented low single-digit increases, with fewer reporting mid-single-digit adjustments. Only a limited number noted double-digit price increases. While cost pressures were present, most businesses avoided aggressive pricing strategies. © Florabundance

© Florabundance

Florabundance team member preparing Valentine's product for shipment to retail florists across the United States

Profitability: a more nuanced outcome

Revenue stability did not always translate into stronger margins. Many businesses reported profitability similar to 2025, while a notable portion described tighter margins driven by freight, labor, packaging, and production cost increases. A smaller group reported improved profitability, and a limited number indicated break-even or margin pressure. Overall, sales stability was more common than margin expansion in 2026.

Holiday timing & market condition

Although Valentine's Day fell on a Saturday this year, most respondents indicated that the calendar shift had minimal impact on overall demand. Sales patterns were described as balanced throughout the week, with steady retail traffic and consistent wholesale movement. While weather-related transportation challenges were reported in certain regions, there was no clear indication that the Saturday placement materially altered total performance.

One multi-location retail florist noted: "Valentines has been good every year since the pandemic." This reflects a broader sentiment echoed by several participants: flowers remain a priority purchase for consumers, even amid economic uncertainty.

© Florabundance

© Florabundance

A familiar presence during busy holiday operations at Florabundance

Conclusion

Valentine's Day 2026 in the United States was not characterized as extraordinary — but neither was it weak. Despite freight increases, labor pressure, tariff discussions, and regional winter weather disruptions, survey responses suggest: sales were steady to strong for most participants, while profitability faced moderate pressure compared to 2025. The overall tone across segments was measured, stable, and resilient.

Methodology

The Valentine's Day 2026 Floral Industry Pulse Survey was distributed directly to more than 40 U.S.-based industry leaders. The survey achieved a 39% response rate and included participants from grower importer wholesaler and retail florist categories representing multiple U.S. regions.

For more information:

Florabundance

Joost Bongaerts

[email protected]

www.florabundance.com