Chain disruption, stock shortages, and high demand are pushing up the price of many products needed in the agricultural and horticultural sectors. ABN AMRO expects the price of energy, fertilizers, feed, and packaging to remain high at least until the second half of 2022. In many cases, the higher costs will have a negative impact on production volumes and the margins of agricultural businesses.

For ornamental plant growers, the past year was good. With an average income of EUR 312,000, it has never been so high. The main reason for this increase is the substantially higher sales prices for ornamental plant products as a result of strong demand. A number of trends that started in 2020 as a result of the corona measures continued in 2021. More people work at home and are more willing to invest in a pleasant living environment, and therefore also in flowers and plants.

In addition, flowers proved to be a good way of giving a gift to family, friends or loved ones who were not allowed visitors. The fact that flowers continue to do well as gifts is reflected in ABN AMRO's transaction data: online spending on flowers in 2021 was also considerably higher than before the COVID-19 crisis. People may be away from home more often now, but ABN AMRO expects consumers to be keen to continue investing in greenery in their environment.

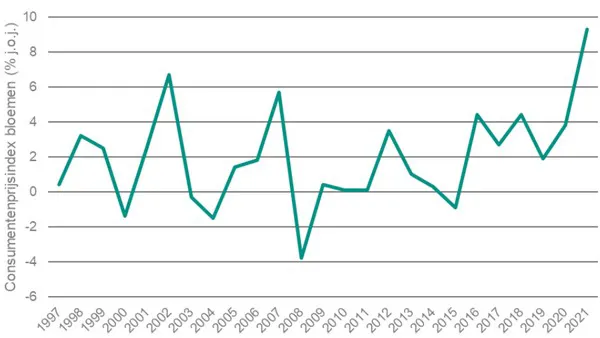

At 9.3%, the price that consumers are prepared to pay for a bunch of flowers has never risen as fast as last year.

More important than the lockdown measures are the consequences of inflationary pressure on consumers in 2022. In both the Netherlands and major consumer countries, such as the United Kingdom, there is a high likelihood that consumers' purchasing power will decline. Inflation is high and wage growth will not sufficiently compensate for higher prices.

In addition, in the UK citizens will have to pay more for their electricity and insurance bills from April. This will also put pressure on the income of many Britons. For the Netherlands, ABN AMRO expects the collective earnings growth in 2022 to be 2.2 per cent, while the inflation forecast is 3.5 per cent. Even incidental wage growth is not expected to be sufficient to correct for inflation.

Flowers and plants are income elastic; if purchasing power declines, consumers may buy fewer flowers and plants. In addition, flowers and plants are also price elastic; when prices rise, demand may decline. A combination of both will occur in 2022. The price that consumers pay for flowers and plants has not yet risen as quickly as in 2021. Last year, the price of flowers and plants for consumers increased by an average of 9.3 percent. If this higher price continues, it could put pressure on volumes in 2022. This does not mean that consumers will no longer buy a bunch of flowers, but it could mean that they will choose a smaller or cheaper bunch. Of course, florists can also vary the number or type of stems in a bouquet so that the price does not increase too much. This is less true for plants, but the demand for plants will be less sensitive to price increases. Next Valentine's Day will show whether consumers adjust their purchases to the price. After all, the traditional rose has risen considerably in price.

Supply

Nevertheless, a possibly lower demand for flowers will not push down the price so fast. On the supply side, there are constraints that will keep prices higher for the time being. The most important restriction is the gas price. Ornamental plant growers are hit disproportionately hard because energy consumption accounts for a significant proportion of the total costs. Entrepreneurs, therefore, choose to leave some of the greenhouses cold or colder, to plant later or less, and to avoid lighting or to use less lighting. This results in a lower supply from the Dutch greenhouses.

There is a scarcity of air freight capacity for the supply of ornamental plants from abroad. This limits the number of flowers that can be transported. ABN AMRO expects there to be a little more capacity in 2022, but the pre-corona crisis level will not be reached for some time. A restriction on supply means that the price-raising effects in the ornamental plant sector will continue to dominate in 2022. Moreover, fertiliser is considerably more expensive, cardboard and paper prices are high and labour is scarce.

source: ABN AMRO