The delays and bottlenecks in the container supply chain will begin to improve at some point and eventually we will see supply chains revert to normality. Whilst welcome news for all stakeholders, this transition will create another problem – a large pile of empty containers on the import side, which cannot readily be handled as part of the normal flows.

In issue 552 of the Sunday Spotlight, we created a model using Ocean Timeliness Indicator (OTI) data published by Flexport to estimate the effect of the increase in transportation time, based on the scenario that the bottlenecks will begin to slowly be resolved starting from mid-February 2022 and we will have returned to normal operations by end-December 2022. This means the current transportation time of 112 days will have reverted to 45 days by the end of the 2022.

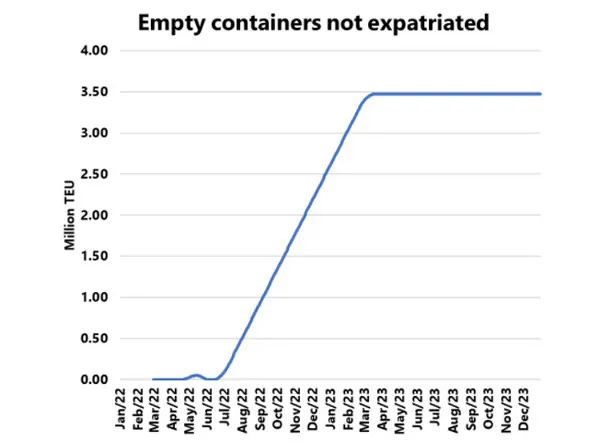

In the scenario of steady operational improvement, we reach a stage where from July 2022 to February 2023 we will see almost 30% more containers returned to the depots in the USA than there is vessel capacity able to move them back to Asia. Based on this daily flow model we created, we can calculate the magnitude of the number of containers which will begin to pile up in the USA. This is shown in figure 1. The Transpacific head haul trade sees the movement of approximately 19 million TEU annually. Applying this to the flow changes we modelled in our analysis, the shortening of the supply chain will lead to a pile of 3.5 million TEU of containers which cannot be expatriated within the planned network operations. This has the potential of overwhelming the empty container depots in the US.

This pile is created within a period of 10 months, and if this is to be resolved within the existing network, it would require that the carriers operate with 82,000 TEU of empty slots on the head haul for 10 months. In reality, this means that an entirely predictable ripple effect from the pandemic, will be a significant problem with empty containers in the USA reaching far into 2023.

For more information:

Sea-Intelligence ApS

Vermlandsgade 51

2300 Copenhagen S

Denmark

info@sea-intelligence.com

ia@sea-intelligence.com