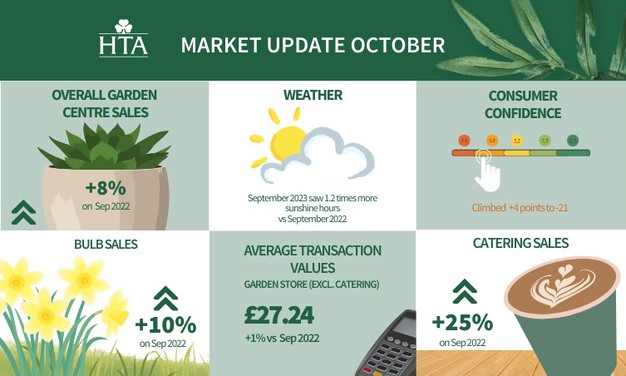

In the latest Horticultural Trades Association (HTA) Monthly Market Update, figures show that the UK garden retail market benefitted from an unexpected sunshine boost, and the sector is optimistic for the final quarter.

Laura Jeffery, HTA Market Research Manager, comments: "As September 2023 continued the trend of uncharacteristic weather for the time of year, with 1.2 times more sunshine hours and temperatures almost two degrees warmer on average compared to the previous year, we can see from the report that this translated to an increase in garden retail sales, with the notable and ongoing exception of weak sales of garden furniture.

"Overall sales and transactions were up by +8% compared to September 2022, with garden tools and plant categories performing well as people began their autumn planting. This also translated into particularly strong bulb sales, up by +10%. In the non-garden/gardening categories, we also saw an +11% boost in sales compared to the previous year, with increased footfall into cafes and restaurants within garden centers and transactions up by an impressive +19% compared to September 2022.

"Looking at the wider context, the Consumer Confidence Index climbed by +4 points in September and a +27 point improvement compared to September 2022. Wage growth across the economy also exceeded inflation earlier this year for the first time in two years. This is likely to have helped increase disposable income and consumer confidence; however, it also puts pressure on business overheads and the ability to recruit and retain the best talent. Despite the rise in confidence, we also remain cognisant that consumer confidence is still in negative territory, and people are grappling with increased costs and financial uncertainty. The value of baskets was only up +1%, and given price inflation, it could indicate less high-value goods in the basket compared to last year, but we are optimistic that our report shows that we are in a better position than last year.

"Looking forward, the garden retail industry remains adaptable and resilient, embracing shifts in consumer behavior and economic conditions. The September numbers and recent months indicate we will see a positive end to the year. Businesses do, however, remain acutely aware of a fine balance between positive signs and challenges, with high input costs, not least energy costs over the winter months, which affects their businesses and their customers."

The HTA has also recently launched a report into the Value of Plants, combining one of the most comprehensive literature reviews ever conducted into research into the value of plants with original research conducted by the HTA among 2,000 consumers into their plant purchasing behaviors. Consumers spend nearly £3 billion per year on plants and trees for their homes and gardens, with around half of this being spent in the UK's garden centers, which receive around 200 million visits per year. By contrast, the broadcast ratings in France for the Rugby World Cup that has swept the host nation have a total cumulative audience of more than 164.5 million.

For more information: Horticultural Trades Association

Horticultural Trades Association

www.the-hta.org.uk